Navigating tax debt can be stressful, and unfortunately, there are scammers out there who prey on individuals seeking relief. Understanding common tax relief scams can help you avoid falling victim to fraudulent practices that could worsen your financial situation. Here are five common scams to watch out for and how to protect yourself.

1. The “Too Good to Be True” Promises

One of the most common tax relief scams involves companies that promise to settle your tax debt for “pennies on the dollar” or make other unrealistic guarantees. They lure in clients with bold claims that sound too good to be true—and they usually are. Legitimate tax relief services will always assess your specific situation and set realistic expectations rather than making blanket promises. Always be skeptical of companies that guarantee results without a thorough review of your tax circumstances.

2. Upfront Fees with No Service

Another red flag to watch out for is companies demanding large upfront fees before providing any services. Scammers will often collect these fees and disappear, leaving you without the promised relief and even more financial stress. Reputable tax relief firms may charge fees, but they will also provide a clear explanation of what those fees cover and will deliver on their promises before requesting full payment.

Tip: Always ask for a detailed fee structure and verify the company’s credentials before handing over your money.

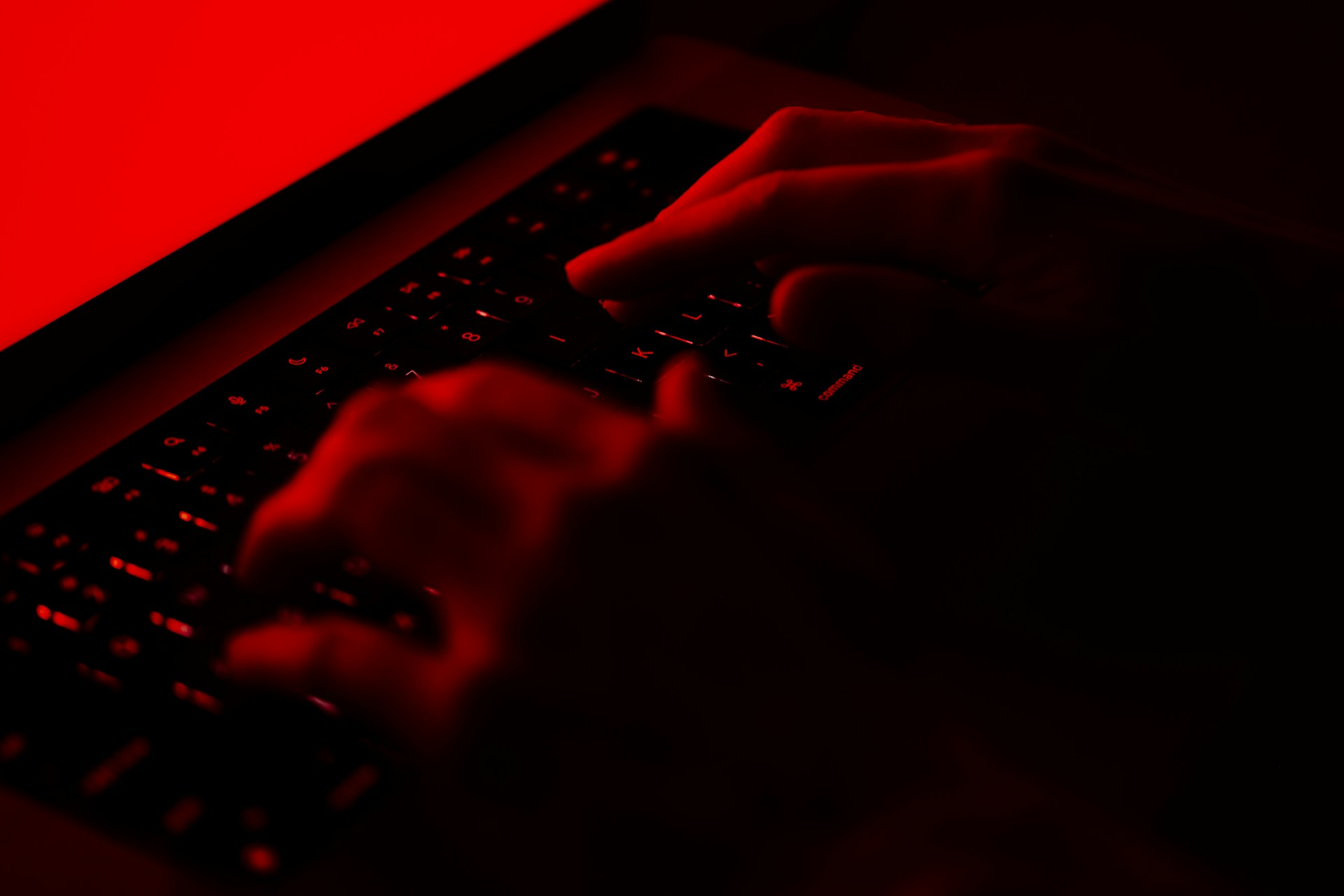

3. Fake IRS Agent Calls

Scammers posing as IRS agents are notorious for threatening individuals with immediate arrest or legal action unless a payment is made right away. These calls are designed to create a sense of urgency and fear, pushing victims to pay quickly without verifying the legitimacy of the caller.

Remember: The IRS will never call to demand immediate payment or threaten legal action without first sending a bill in the mail. If you receive such a call, hang up immediately and report it to the IRS.

4. Phishing Emails and Fake Websites

Official-looking emails are a common way tax relief scammers use to get your information.

Official-looking emails are a common way tax relief scammers use to get your information.

Phishing scams involve emails or websites that mimic legitimate tax relief services or government agencies, tricking you into providing sensitive personal information. These scams often promise quick resolutions to your tax problems if you provide your Social Security number, bank account details, or other personal data.

How to Protect Yourself:

- Always verify the authenticity of any website or email before entering personal information.

- Never click on links from unknown sources.

- Legitimate tax relief services will use secure websites and official communication channels.

5. Bogus “Tax Professionals”

Lastly, some scammers pose as tax professionals, using fake credentials or no credentials at all. They may offer to negotiate with the IRS on your behalf, only to disappear once they’ve collected your money.

Action Step: Always verify that the tax professional you’re working with is properly licensed, such as a Certified Public Accountant (CPA), Enrolled Agent (EA), or a licensed attorney. Check their standing with the Better Business Bureau and other professional associations to ensure they are legitimate.

In summary, protecting yourself from tax relief scams requires vigilance and skepticism. Always do your research, verify credentials, and avoid companies that make unrealistic promises or pressure you into immediate payments. By staying informed and cautious, you can find the legitimate help you need to resolve your tax issues without falling victim to fraud.

Share